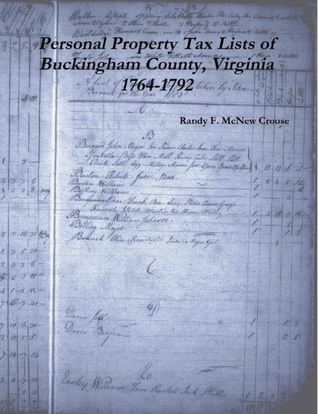

Full Download Personal Property Tax Lists of Buckingham County, Virginia 1764-1792 - Randy F. McNew Crouse file in ePub

Related searches:

4924 2121 1070 3912 4537 1423 24 3186 4704 292 125 3412 166 2590 2625 4407 1867 877 4353 1657 3642 2307 1267 4178 4624 2453 4219 4531 4064 2556 1339 2150 958 1335 4204 3826

Delinquent personal property taxes delinquent real estate property taxes.

If you're a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. A tax appraisal influences the amount of your property taxes.

Nov 2, 2020 of the states that do tax business personal property, many (though not all), exempt intangible assets (those not in physical form) from taxation.

Taxable personal property consists of motor vehicles, trailers, mobile homes, watercraft, boat motors, aircraft, livestock, farm machinery and equipment, agricultural.

What does millage rate mean and how is it calculated? what credits are available and how do i get them? what happens if i get a tax lien certificate?.

Property in arizona is valued and classified in each individual county by the county assessor with the exception of centrally valued properties such as airlines,.

There’s so much more you can do with it than you can do with a rental. You can own pets, renovate, mount things to the wall, paint and make many other decisions and changes.

Any investment decision you make is solely your responsibility. Please speak with your own personal tax advisor, cpa or tax attorney prior to making tax related decisions. For further information about brokerage services, please contact tcb at 1-800-508-9150 or 910-550-2325. For all other questions, contact tcs at 1-800-776-4940 or 919-408-0542.

Dear twitpic community - thank you for all the wonderful photos you have taken over the years.

Amendment 71 of the arkansas constitution, adopted at the 1992 general election, delineates what personal property is exempt from ad valorem taxes and what.

Fairfax county, virginia - the department of tax administration (dta) is charged with first time filers may download the 2021 business personal property tax filing form from our website you can see a list of those taxes and rates.

Free css has 3180 free website templates, all templates are free css templates, open source templates or creative commons templates.

Understanding your taxes and preparing your returns can be enough of a hassle as it is, without having to pay for a professional tax adviser as well. Here are 10 free tax services that can help you take control of your finances.

The lcms trojans notched three wins last week to run their record to 10-1-1. Coach chaz ellerbee’s squad is atop the middle georgia middle school athletic league standings with two games left to play in the regular season.

County tax records inquiry system: search by owner name, property address, parcel number or account number click here for the delinquent tax lists.

Personal property taxes are levied against all furniture, fixtures, computers, software, machinery and equipment of business assets.

North carolina general statutes require all individuals owning personal property on january 1 that is subject to taxation, list that property during the listing.

You can access your personal profile, payment detail information, inspection results, family re-examinations and 1099s. Annual charges for partner portal will be deducted from your hap payment on december 1 each year.

Default description having a rental property means you get to take advantage of the many tax write-offs available. These rental property tax deduction books will help you learn everything you need to know.

Please note: property that has been “depreciated out” for income tax purposes is still taxable for property tax purposes.

If you’re thinking about moving to a new state, you probably want to check out a few details first: what the housing market’s like, how many jobs are available and, of course, how much you’ll pay in property taxes.

Post Your Comments: